According to Wikipedia[1], Air Liquide is a French multinational company which supplies industrial gases and services to various industries including medical, chemical and electronic manufacturers. Founded in 1902, after Linde it is the second largest supplier of industrial gases by revenues and has operations in over 80 countries. It has headquarters at the 7th arrondissement of Paris, France. Air Liquide owned the patent for Aqua-Lung until it expired.

Although Air Liquide’s headquarters are in Paris, France, it also has major sites in Japan (ALL) and Houston, TX and Newark, DE, USA, Frankfurt, Shanghai and Dubaï. There is an emphasis on research and development throughout the Air Liquide company. R&D targets the creation of not only industrial gases, but also gases that are used in products such as healthcare items, electronic chips, foods, and chemicals. The major R&D groups within Air Liquide focus on analysis, bioresources (foods and chemicals), combustion, membranes, modeling, and the production of hydrogen (H2) gas. The company is a component of the Euro Stoxx 50 stock market index. As of 2019, the company is ranked 500 in the Fortune Global 500

Basic analysis based on the released annual reports[2]

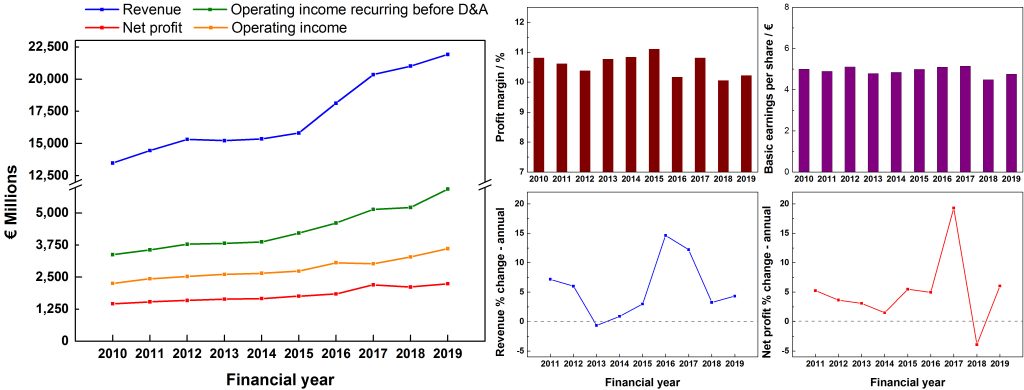

a) Income statement

Operating income recurring before D&A: Net income from recurring operations before depreciation and amortization

Profit margin: Net profit / Revenue

Revenue % change – annual : [Revenue(present year) – Revenue(previous year)] / Revenue(previous year)

Net profit % change – annual : [Net profit(present year) – Net profit(previous year)] / Net profit (previous year)

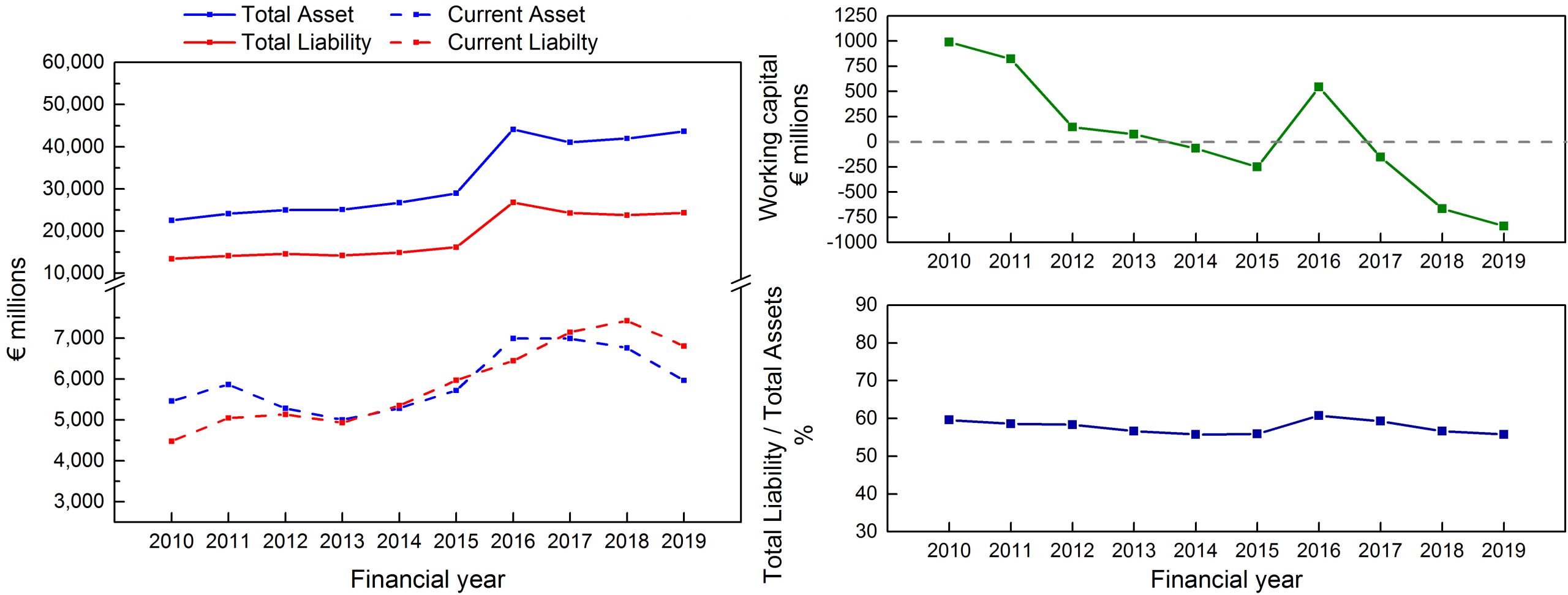

b) Balance sheet

Current assets : represent all the asset of a company that are expected to be conveniently sold, consumed, used, or exhausted through standard business operations with one year.[3]

Current liabilities : are a company’s short-term financial obligations that are due within one year or within a normal operating cycle.[3]

Working capital : Current assets – Current liabilities

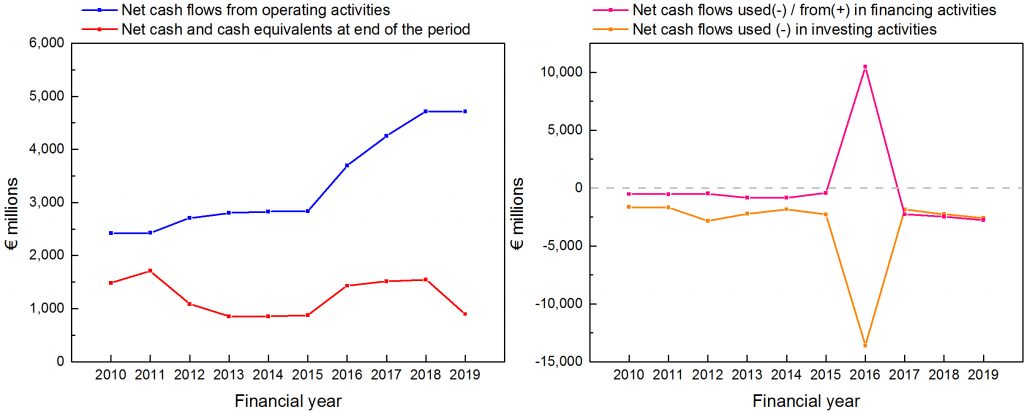

c) Cash flow

Net cash flows used in / from financing activities: shows the net flows of cash that are used to fund the company. Financing activities include transactions involving debt, equity, and dividends.[3]

Net cash flows used in activities: provides an account of cash used in the purchase of non-current assets or long-term assets that will deliver value in the future.[3]

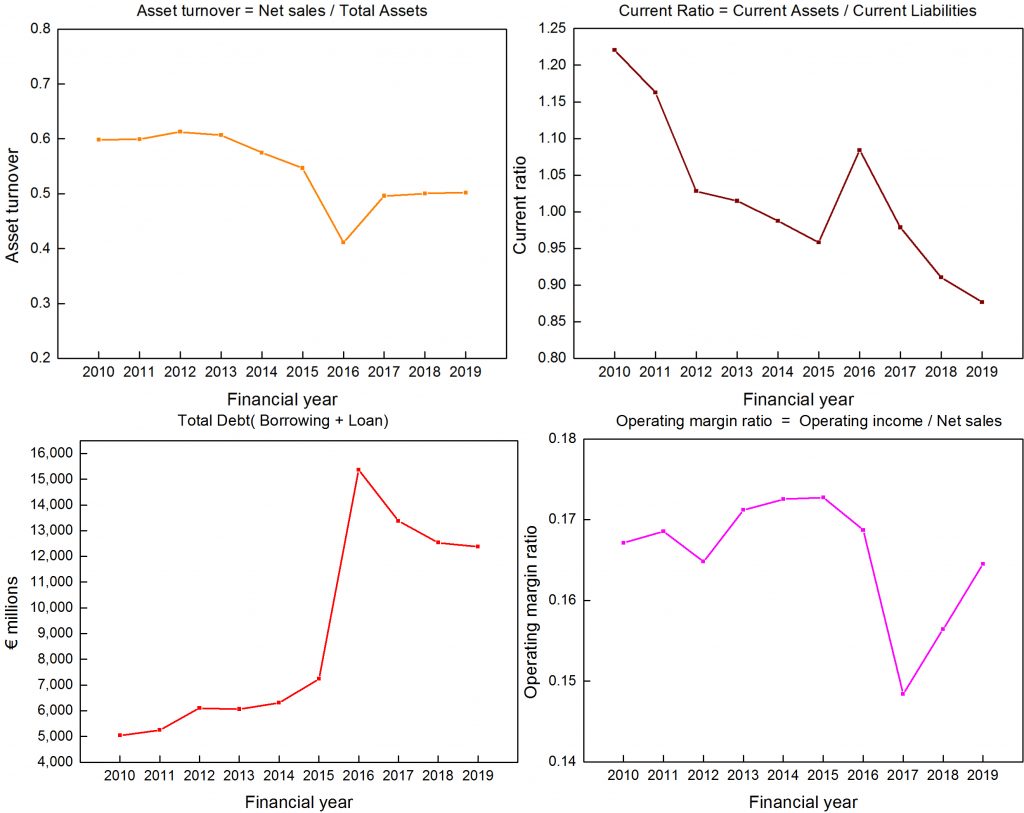

d) Other financial related value

Asset turnover: Revenue (net sales) / Total assets. This ratio indicates how effectively companies are using their assets to generate sales.[3]

Current ratio: Current assets / Current liabilities. The current ratio is a liquidity ratio that measures a company’s ability to pay short-term obligations or those due within one year.[3]

Operating margin ratio: Operating income / Revenue(Net sales). Operating margin of a company is a good indicator of how well it is being managed and how risky it is. It shows the proportion of revenues that are available to cover non-operating costs, like paying interest.[3]

Notable events in recent years

Acquisition of Airgas in 2016:

It is stated by Air Liquide that acquisition’s strong industrial and market logic ideally positions the company for future growth and long-term value creation, and by this acquisiton Air Liquide strengthens its global leadership in the industrial gas industry.[4] The impact of this acquisition also reflects on the financial reports, as shown in the figures above.

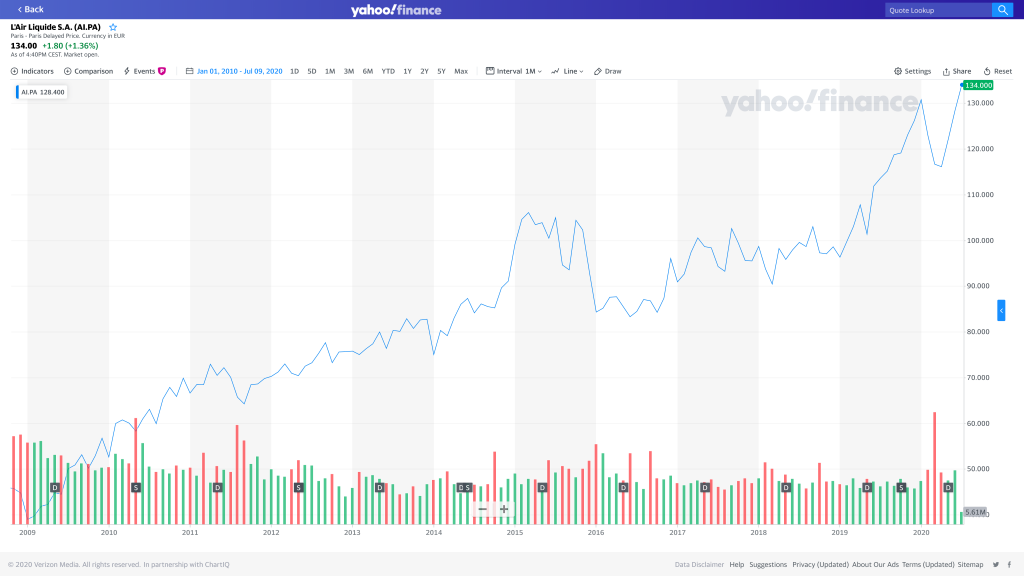

Stock price history cited from Yahoo Finance[5]

Reference

[1] https://en.wikipedia.org/wiki/Air_Liquide

[2] https://www.airliquide.com/investors/documents-presentations

[3] https://www.investopedia.com/

[4] https://www.airliquide.com/united-states-america/air-liquide-completes-acquisition-airgas